The future of a 61-cent property tax slated to drop off the books in 2024 was the focus of discussion at a St. Joseph School District finance committee meeting on Monday.

The conversation centered on two options: raise the tax to 81 cents, with a sunset clause, to go toward teacher and staff salaries or keep the amount at 61 cents but eliminate a sunset clause to make it permanent. The St. Joseph School Board may decide to take the issue to voters in August. No final decision has been made on what to present to voters.

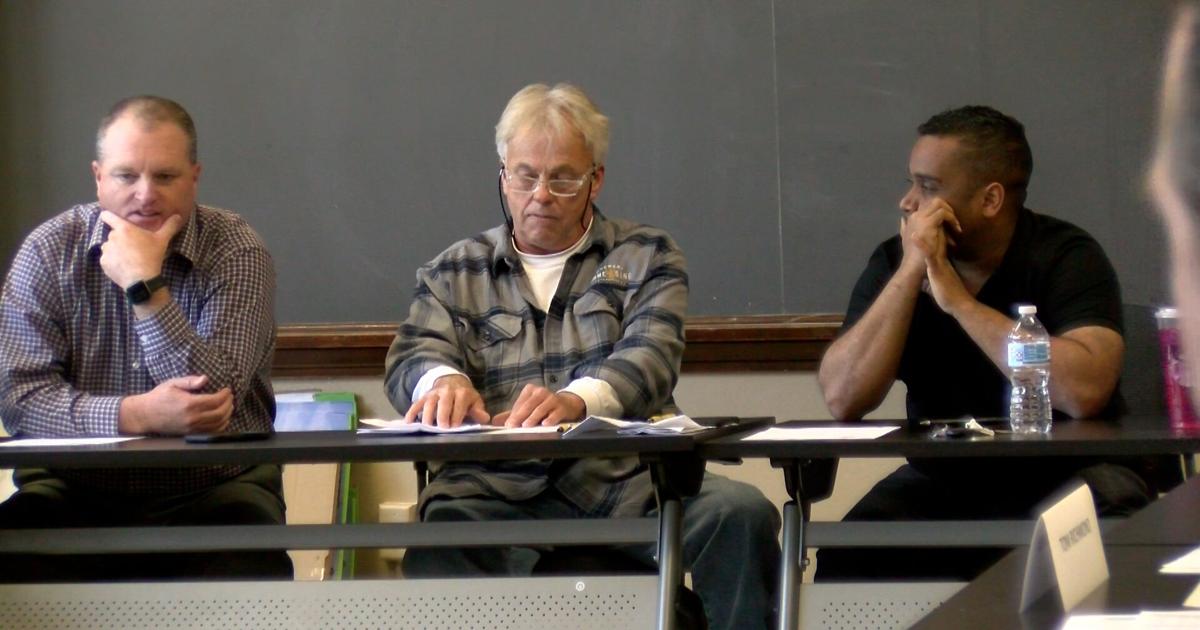

Doug Van Zyl, superintendent of St. Joseph School District, said having too many options on a ballot creates confusion and generally discourages voters. He encouraged the council to come to a conclusion on a tax proposal, without leaving the two to public debate.

Board of Education member Kenneth Reeder and Gabe Edgar, who is expected to become the district’s next superintendent this summer, jointly discussed other tax-related issues, including school closures and consolidations, noting that more the public is able to quickly vote on the tax. , the sooner these problems can be resolved.

“For me, that’s the reason to race in August. We have to start those conversations, we have to lead them,” Edgar said when asked what his priorities were to discuss with the community. “If this passes in August, these conversations have to start on August 4, or whatever the day after.”

When talking about a tax increase, board members wondered whether or not the community would buy into it and vote for it.

Committee members also discussed the option of asking for the 81 cents initially and, if the public votes against, going back to the 61 cents as a compromise.

An overwhelming concern centered on “when” to vote on the issue. Edgar stressed that it is in everyone’s interest to present any changes to the tax to the community as soon as possible.

“We’re releasing it in August because, as you know, we have a lot to do and we’d rather start those conversations now,” Edgar said. “Because if you start them in April 2023, guess what? You’re already in ’24, ’25 before you can do anything… So that’s our selling point.

The committee disbanded after an hour-long discussion with Edgar taking talking points from the meeting to the full board and getting sample ballots with the two proposed tax amounts to split. with the group.

The board will vote to move forward with a decision later this month. Otherwise, the committee will hold a special session to revisit the conversation.

After 2024, not extending the tax could result in a wage freeze and about $8 million in budget cuts.